PCI DSS 101: Compliance Simplified by Devolity

Discover how to navigate the complex world of PCI DSS compliance with our comprehensive guide for beginners. Devolity will Simplify compliance today!

Table of Contents

- Introduction to Payment Card Safety

- What is PCI DSS?

- Why We Need PCI DSS

- Steps to PCI Compliance

- PCI DSS Requirements Breakdown

- What If You’re Not Compliant?

- How to Stay PCI Compliant

- Summary

- Frequently Asked Questions (FAQs)

Introduction to Payment Card Safety

We’ll start off by explaining what PCI DSS is and why it is so important for keeping our money safe when we use cards to buy things. When you go to a store and use your card to pay for something, you want to make sure that your money is safe and secure. That’s where PCI DSS comes in to help keep your card information protected.

Stay informed on PCI DSS compliance with our newsletter!

Get the latest updates and tips to simplify your compliance process.

PCI DSS stands for Payment Card Industry Data Security Standards. It’s like a set of rules that stores and businesses have to follow to make sure that when you swipe your card to pay, your personal and financial information is kept safe from bad guys who might try to steal it. So, whenever you see that logo with PCI DSS on it, you can be sure that the store is working hard to keep your money safe.

What is PCI DSS?

When you hear about PCI DSS, it might sound like a secret code, but it’s actually a very important set of rules that make sure your money stays safe when you use your card to buy things. PCI DSS stands for Payment Card Industry Data Security Standards – a mouthful, but it’s like having a superhero protecting your card information every time you swipe or insert your card to pay for something.

Imagine if your card information was like a treasure chest, and you want to make sure it’s locked up tight so no one can steal it. That’s what PCI DSS does – it sets up the rules and guidelines that stores and businesses need to follow to keep your card details safe from bad guys who might try to hack into their systems and steal your information. So, when you see a store with a sign that says they’re PCI compliant, it means they’re following all these rules to keep your money safe. That’s pretty cool, right?

So basically, PCI DSS is like having a guard dog watching over your treasure chest of card information, making sure it’s secure and out of reach from any sneaky thieves. It’s all about keeping your money safe and sound whenever you use your card to buy something. Safety first!

Why We Need PCI DSS

When you go to the store and use your card to buy something cool, you want to make sure your money stays safe, right? That’s where PCI DSS comes in to save the day! It’s like a secret code that makes sure bad guys can’t sneak in and steal your card details.

Protecting Your Money

Imagine if there were no rules in place to keep your card info safe. Scary, right? That’s why PCI DSS is so important. It sets up strict guidelines for stores and businesses to follow, making sure they use special locks and alarms to protect your money.

Safe Shopping for Everyone

Not only does PCI DSS keep your money safe, but it also helps keep everyone’s money safe. From big stores to your favorite online shop, they all have to play by the same rules to make sure no one’s card details get into the wrong hands.

Next time you swipe your card at the store, remember that PCI DSS is working behind the scenes to keep your money safe and sound!

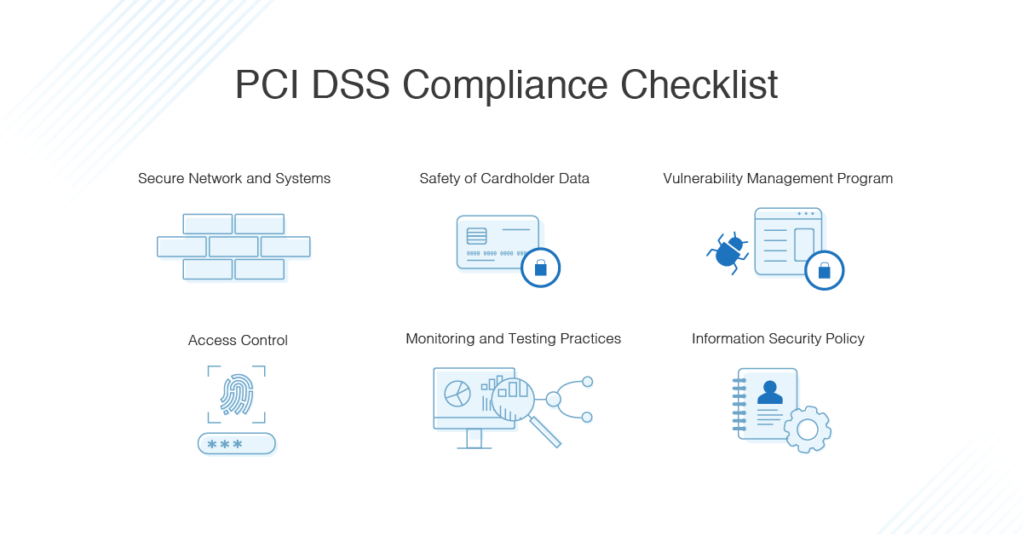

Steps to PCI Compliance

When it comes to keeping your money safe, following the rules is super important. Let’s take a look at the steps that shops and businesses need to follow to make sure they’re playing by the PCI DSS rules.

Understanding the Requirements

Imagine PCI DSS requirements as a big list of things that shops need to do to get a gold star in card safety. These requirements are like a blueprint for keeping your card information safe when you make a purchase.

Putting the Rules into Action

Now, let’s see how these rules are used in real life. It’s like having a safety checklist to make sure that every step is followed to keep your card information secure. From encrypting data to regularly monitoring transactions, these rules help businesses create a safe environment for your card details.

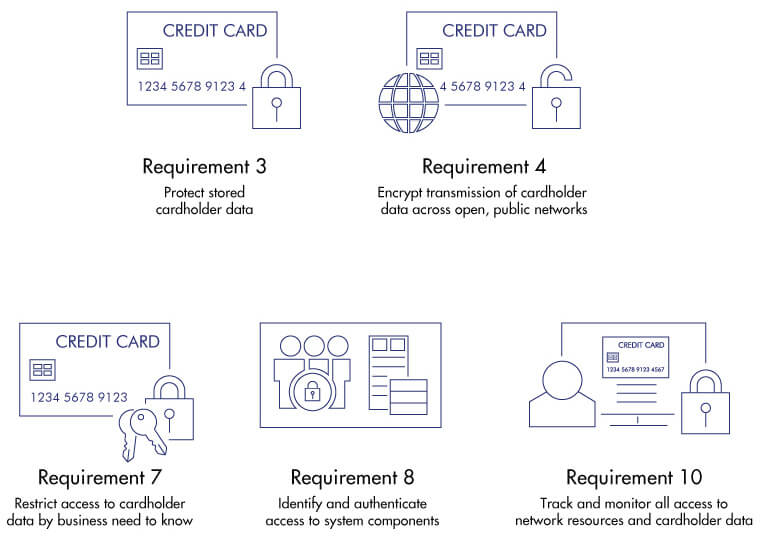

PCI DSS Requirements Breakdown

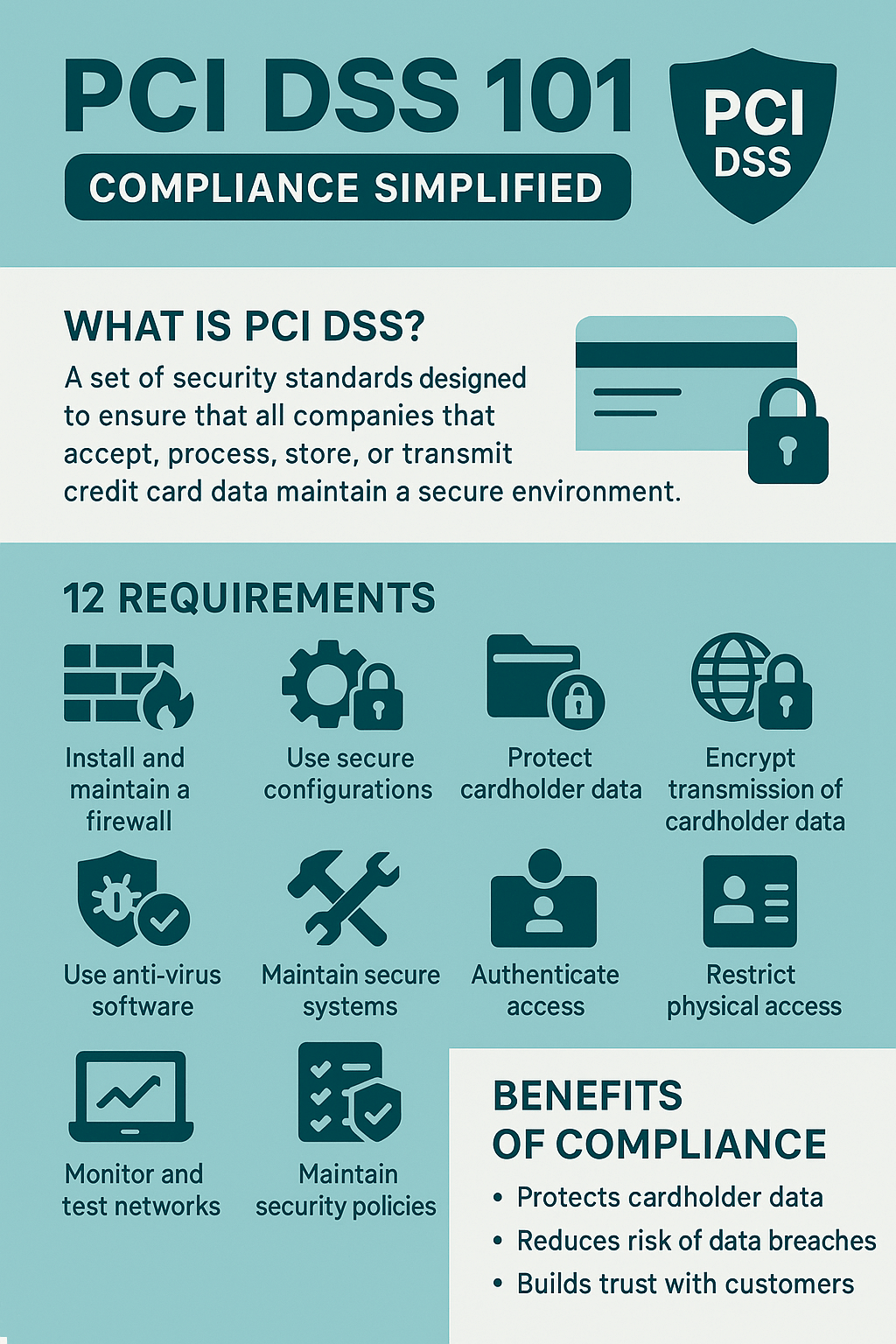

When it comes to keeping your card information safe, there are specific rules that businesses need to follow. These rules are known as the Payment Card Industry Data Security Standard (PCI DSS). Let’s break down the main points of PCI DSS into simple pieces so you can understand what each one means.

Image courtesy of www.dnsstuff.com via Google Images

Understanding the Requirements

Shops and businesses that handle card payments need to make sure they have strong security measures in place. This includes things like having a secure network, encrypting card data, and regularly monitoring their systems for any suspicious activity. These requirements are all part of PCI DSS to ensure that your card information is safe and protected.

Putting the Rules into Action

Imagine PCI DSS as a safety checklist for businesses. They need to regularly update their security systems, train their employees on how to handle card information safely, and conduct regular security audits. By following these rules and putting them into action, businesses can help prevent data breaches and keep your card details secure.

| Section | Description |

|---|---|

| What is PCI DSS? | The Payment Card Industry Data Security Standard (PCI DSS) is a set of security standards designed to ensure that all companies that accept, process, store, or transmit credit card information maintain a secure environment. |

| Who Needs to Comply? | All organizations that handle credit card information, including merchants, service providers, and financial institutions, are required to comply with PCI DSS. |

| Why is Compliance Important? | Compliance with PCI DSS helps protect cardholder data, reduce the risk of breaches, and maintain trust with customers and partners. |

| Key Requirements | Key requirements of PCI DSS include maintaining a secure network, protecting cardholder data, implementing strong access control measures, regularly monitoring and testing networks, and maintaining information security policies. |

| How to Simplify Compliance | Organizations can simplify compliance with PCI DSS by implementing a comprehensive security program, conducting regular assessments, training employees on security best practices, and partnering with experts in data security. |

What If You’re Not Compliant?

Uh-oh! So, what would happen if a store doesn’t follow the PCI DSS rules? It’s kind of like not doing your homework or forgetting to brush your teeth – there are consequences. And in this case, the consequences can come in the form of fines. Yep, that’s right – money talks, and in this case, it might walk right out of the store’s pocket!

These fines are no joke. They can really add up and make things pretty tough for a business. Imagine not having as much money to buy new toys or treats – not fun, right? That’s why it’s super important for shops to follow the rules and stay compliant with PCI DSS.

Just like how you might get in trouble if you don’t follow the rules at school or at home, stores can get in trouble if they don’t follow the PCI DSS requirements. But don’t worry, it’s all to keep everyone’s money safe and sound!

How to Stay PCI Compliant

When it comes to keeping your money safe, following the rules is super important. Here are some tips and tricks for shops and businesses to make sure they always follow the Payment Card Industry Data Security Standard (PCI DSS) rules.

Image courtesy of cpl.thalesgroup.com via Google Images

Understanding the Requirements

First things first, let’s look at what stores need to do to get a gold star in card safety. This means making sure that all the card information that customers share is kept super safe. Stores need to follow specific rules to protect this information from bad guys who might try to steal it.

Putting the Rules into Action

Now that we know what the rules are, let’s see how they are used in real life. Think of it like a safety checklist for keeping card info safe. For example, shops might need to use special technology to encrypt card details, or they might have to regularly update their security systems to stay ahead of potential threats.

Summary

Now that we’ve learned all about PCI DSS, let’s recap everything we’ve discovered about this superhero of card safety.

PCI DSS, which stands for Payment Card Industry Data Security Standard, is like a set of super strict rules that make sure our money stays safe when we use cards to buy things. These rules are super duper important for all the big shops and businesses out there, as well as for us little shoppers.

To be PCI compliant, stores have to follow a bunch of steps to make sure they’re playing by the rules. These steps are like a safety checklist to keep all our card information safe and sound. It’s kind of like wearing a seatbelt in a car to keep us safe on the road!

Breaking down the main points of PCI DSS into tiny pieces makes it super easy to understand what each rule means. Think of it like breaking a big chocolate bar into tiny pieces for easy munching!

If a store doesn’t follow the PCI DSS rules, they could get a timeout in the form of fines. Just like getting grounded for not following the rules at home, stores can get into trouble if they don’t keep our card info safe.

So, to make sure shops and businesses always follow the PCI DSS rules, they can use some tips and tricks to stay compliant. It’s like having a secret weapon to fight off any bad guys trying to steal our card info!

With PCI DSS by our side, we can all feel a little bit safer when we swipe our cards to buy treats. It’s like having a shield of protection around our money, keeping it safe from any sneaky hackers or thieves!

Frequently Asked Questions (FAQs)

What exactly is PCI DSS?

PCI DSS stands for Payment Card Industry Data Security Standards. It’s like a superhero team for card safety, making sure your money stays safe when you use your card to buy things. Think of it as a set of really important rules that stores and businesses have to follow to protect your money.

Why do shops have to follow PCI DSS?

Shops and businesses have to follow PCI DSS because it’s super important for keeping everyone’s money safe. Just like how we lock our front doors to keep our homes safe, PCI DSS is like a lock on card payments to make sure bad guys can’t sneak in and steal our money.

What happens if someone doesn’t follow the PCI DSS rules?

If a store or business doesn’t follow the PCI DSS rules, they could get into big trouble, just like not following the rules at school can get you into trouble. They might have to pay fines or face other consequences. So, it’s really important for them to play by the rules and keep our money safe.

Transform Business with Cloud

Devolity simplifies state management with automation, strong security, and detailed auditing.